What is the Inflation Reduction Act (IRA)?

Signed into law on August 16, 2022, The Inflation Reduction Act, or IRA, represents the largest US legislative investment in energy efficiency and clean energy, and stands as a significant climate bill in many respects, including that the IRA uses “carrots” to incentivize investment over “sticks” like fees and punishment. Though it’s not apparent that the act in its entirety or specific tax healthcare and climate provisions will have a direct negative impact on inflation or that this name accurately reflects the legislation’s main purpose*, it is very clear that we should expect from the IRA and other related recent legislation a transformative effect on buildings, everyone who lives, works, learns and plays in buildings (yes, all of us), infrastructure and water systems, jobs and manufacturing capacities, supply chains, and a real acceleration in the evolution and growth of energy efficiency and clean energy products, services, technologies, companies, market segments, and entire markets.

The IRA contains approximately $370 billion of energy and climate-related grants, loans, rebates, tax incentives and other investments for households, businesses, agencies, organizations, and institutions. Many of these provisions will directly and positively impact the green building and wider building industry. For example, funding for improved energy codes will of course impact all buildings and builders. Energy efficiency and clean energy tax credits, grants, rebates, and loans will also result in additional building products in the marketplace, and more work for building professionals. Success of these programs depends on increased demand for sustainable materials over alternative choices, which will in turn depend on education and training. Building occupants need sufficient information to make informed decisions, and the building workforce must be ready to deliver and execute.

The actual impact might be far bigger than the frequently cited investment estimate, as many of the law’s provisions do not have caps. In line with Justice40, the Biden Administration’s Environmental Justice Initiative which mandates the allocation of 40 percent of certain federal benefits to disadvantaged communities that have been overburdened by pollution, many benefits of the act are reserved for or give extra commitments to occupants of low-to-middle income households and communities. The act also contains targeted benefits for Tribal communities, rural areas, and “Energy Communities,” areas which formerly hosted a coal mine or coal-fired power plant, or which remain economically dependent and/or disadvantaged by fossil fuel related facilities and processes, with negative economic consequences.

What will the Inflation Reduction Act (IRA) Achieve for Energy Efficiency and Clean Energy?

All of these investments will add up to reduced environmental impact compared to the unacceptable “business as usual” activity and economy climate-related scenarios that continue to put a healthy and safe future for humanity at risk. The Department of Energy estimates that the IRA, along with the Bipartisan Infrastructure Law and other legislation, will help the US show needed leadership and achieve critical and committed climate goals, including 50-52% greenhouse gas emissions reductions below 2005 levels by 2030 (The IRA and existing related legislation accounts for 40% of this mandate, with the other 10-12% expected from continued public and private actions not currently fully accounted for), 100 percent carbon pollution-free electricity by 2035, and net zero emissions economy-wide by no later than 2050.

The IRA was to begin on January 1, 2023, so I somewhat regularly checked in before and after this date. I kind of kept waiting to feel deluged with information about “how this is all going to work,” and then I started wondering, “Does everyone else know what’s going on, and it’s just me?” Where were the “IRA Directions” I could find and report on, and reshare? Was I doing something wrong? Was something wrong? I mean, when I first looked on the IRS website, I saw a message that seemed to say, "Check back for more information later.” There’s still a similar message, but thankfully there is also more information now. I recall thinking this program starts in 2023, "How are we going to make this happen if we don’t have the instructions?"

I wanted (and still want) to know more details, including some information I admit it’s not entirely possible to know yet:

-

What is the total impact really going to be? As in, is this the real start to mainstreaming the transition to a cleaner energy economy? I know we see some big and varying estimates in hundreds of billions of dollars, but what will this really mean to the average, real person, and will it change their quality of life or even their lifespan somehow?

-

Also, what’s the real environmental impact of all of this investment, and how will we make up for the gaps between what the IRA can achieve and our climate commitments?

-

How can we really make this impact equitable? Reserving funds sounds great, but how do we make sure the people who are in disadvantaged communities get access to the information they need?

-

Will renters be able to benefit, and how much? How would these processes work?

-

What are the benefits going to be for businesses for their buildings and operations, and also for those who make or sell more energy efficient or clean energy products or related services? Where and how will they learn how to take advantage of the IRA?

-

How many jobs will this legislation really help create? (The projections really vary.)

-

How are we going to educate everyone who isn’t an energy efficiency or energy expert? Where and when will people be able to ask questions and get practical, actionable answers?

-

And also, how are we going to be able to provide additional education for industry professionals, particularly emerging professionals, so they’re trained and ready to do this work. According to the National Skills Coalition, the IRA should ideally contain $40 billion to support workforce or occupation-specific training, but falls short with approximately $4.5 billion that can be allocated for this purpose. The IRA does contain tax credits with provisions for wage levels and workers’ access to apprenticeships.

I have started to find some answers, and also to ask even more questions. Although the information we have might consist of generalizations or widely varying estimates, we do have a sense of what the IRA will achieve. Among the expectations:

-

For individuals:

-

For both individuals and companies, the IRA reduces energy bills. According to DOE, the IRA may provide $1 billion a year in household energy bill savings alone. Rewiring America predicts the average household will save approximately $496 per year, totalling $373 a year for the 85% of US households which could benefit from a switch to more modern, efficient equipment.

-

Additional supply and equity commitments will result in narrowing socioeconomic energy efficiency and clean energy gaps, if there is sufficient marketing and education, and if there’s a real and sustained effort to direct these funds where intended - and using communication channels that work for targeted stakeholders.

-

Health benefits will improve as old, energy efficient equipment is replaced and as emissions decrease. Indoor air quality (IAQ) improvements, including better managing, reducing or even eliminating combustion inside buildings, should result in both direct and wider environmental health improvements

-

With additional control and better technology, comfort for individuals inside buildings will increase

-

Energy efficiency and clean energy job opportunities will expand (see estimates below)

-

-

For companies, industry, institutions, organizations, the government, and the wider community:

-

Federal investments and incentives for energy efficient and clean energy technologies and products, including electric vehicles, will spur additional private sector investments (This is already happening), increasing both development speed and overall supply

-

IRA investments will increase jobs, by approximately 50,000 jobs per year by one estimate (American Progress estimates that over 170,000 jobs were created in the first year after the IRA passed, but this may be consistent with an overall average, or the numbers may indeed be higher. Exact counts will be difficult, and estimates vary greatly. One source estimated over 9 million jobs in the first IRA decade will be created.)

-

Sustainable manufacturing, and more local manufacturing will increase

-

Support and awareness will increase for firms working in energy efficiency, clean energy, and related industries. These companies will benefit and expand, and will also inspire others to follow their lead.

-

Funds targeted specifically at affordable housing development will create opportunities for firms working in this space, in addition to increasing energy efficiency and clean energy access

-

The IRA will also create opportunities for the real estate industry, as homes and buildings are upgraded and become more valuable. Savvy real estate professionals who can explain how to best take advantage of upgrades and how sellers can evaluate and compare related improvements will experience an early advantage and will benefit as leaders in their field.

-

The number of energy efficient and clean energy building retrofits completed will increase, reducing air pollution and overall environmental impacts

-

Improved building codes, including improved adoption processes by states, means each new building or retrofit will have a reduced impact - and sooner

-

Increased infrastructure investing will lead to more construction and development projects, many of which are sorely needed and overdue, and all of which will hopefully be executed more sustainably

-

If job training programs are sufficient, this should help more people transition to cleaner energy careers, and also provide the workforce desperately needed for this transition

-

What is the status of the Inflation Reduction Act (IRA)?

The thing is, the IRA is complex and confusing, and involves quite a few stakeholders, and… it’s not quite all ready yet. This partial start was and remains surprising to me, as January 1 2023, felt like it should have been a big exciting deadline or kickoff. I’ve also been surprised that there isn’t more information about what people and companies can do to get started earning all of these credits and rebates. But that’s the point of really trying to work this through and starting a wider conversation where we can all share what we know and make more progress together. There’s just so much educating for all of us to do, including me. Believe me, if you are confused about how the Inflation Reduction Act is going to work, and how all this funding for energy efficiency and clean energy will get into the hands of actual homeowners and renters, you are not alone. And if you’re an expert and somehow also a storyteller about tax credits and rebates, I’d love to hear from you! I will keep sharing what I am finding, and suggestions and edits, and entire additional pieces are welcome. I’d also like to hear about additional information sources I can point to.

The good news is that it’s clear the IRA is going to make a real difference in all the ways mentioned and more, especially over time, and that some of the program is already in progress. As of January 1, 2023, there are many tax credits available. These aren’t all new. The IRS (and state governments) already had a host of tax rebates available, and some have been changed and others added. I’ll report on some details below, but generally speaking there are so many improvements you can get tax credits for RIGHT NOW. And I don’t think it’s clear to everyone yet how much money this can add up to.

$150 million in funding is also now currently available for states to create and implement programs to support training home energy and efficiency and electrification professionals. States can develop training tools, subsidize training, provide testing and certification, and partner with organizations to deliver training. These funds are important to workforce development, as there are currently insufficient numbers of trained and available energy efficiency and clean energy employees in many areas. States must apply for the funds before September 30.

So the less great news is that all of the IRA mechanisms are not in place yet. The process to figure out how all the rebates are going to work is ongoing, and rebates are not currently available. IRA funds were approved by Congress as early as January 1, 2023, but it has taken longer than some expected for the Department of Energy DOE to set guidelines for how the state energy offices (SEOs) should administer the rebates. DOE released guidelines to states on July 27, 2023 on how to apply for the planned DOE funding. The states then follow their own processes, including allowing for public comment, and submit these applications. It’s anticipated that DOE will begin approving applications and the first rebates will be available sometime in 2024. Unfortunately the rebates are not retroactive, and there’s some reason to worry this means some beneficial projects are likely being delayed, to the detriment of the professionals and occupants involved, as well as the environment.

Another challenge is that there is a great deal of educating required in order to inform homeowners and occupants and commercial building owners and decision makers about available benefits sufficiently to grow demand rapidly enough to enact the change needed to meet critical climate goals, How can people know to ask for products and services they might not know much about as part of programs they’re not sufficiently aware of? It’s not clear how educational or training funds will work yet, and it seems that the companies who want to sell the energy efficiency and clean energy products and perform the upgrades will end up needing to teach as they work to sell. In a sense, this is part of marketing, but there’s a societal interest here in getting this information out. There are already some energy efficiency and clean energy state programs that do this kind of information sharing and promotion. Perhaps they can act as models for other states and/or expand their work. We're searching for the best information sources as well, and w've started an IRA Resources & Tools list we're happy to keep improving.

The Inflation Reduction Act (IRA) and the Building Industry:

The Inflation Reduction Act (IRA) represents a significant growth opportunity for companies already playing a leadership role in the energy efficiency and clean energy sectors of the green building industry, as well as for those companies that have not yet transitioned to more sustainable products and practices. What Can Businesses and Entities do now to take advantage or to prepare to take advantage of the IRA? It’s exciting news of course that all of these credits and rebates (when available) will significantly impact new and existing buildings going forward, but what does this massive amount of funding mean for building industry companies and professionals? How can you take advantage of existing credits and opportunities for your company, and prepare for the rebates and other financing to come?

-

First, familiarize yourself with these programs.

-

Check out our tools and resources list and see which information is most helpful to you. You’ll find a variety of options, including tax credit calculators, lists of tax credits, links to funding information, webinars on the IRA, even examples of tax forms for some credits, and links on how to fill them out. We’ve put together the list of what we found, and we’d appreciate your ideas on helpful resources to add.

-

-

Determine which opportunities fit your existing business, and consider if you might be able to expand and add capacity to take advantage of additional possibilities. This sounds easier than it might be at first, just because these credits and incentives are complicated and are at different stages of readiness.

-

Prepare as much as possible in advance to communicate effectively with clients and potential clients how they can take advantage of energy and clean energy tax credits and incentives, as appropriate, and to explain the benefits of these improvements. As stated, a lot of the educating will fall to green building companies, and it’s to your advantage to become a knowledgeable and trusted advisor and to be able to counsel clients effectively about best solutions.

-

Investigate what training programs are available in your area. IRA training funds will be administered by states and are not yet ready. However, there may already be existing programs in your state. You can help your clients earn tax credits NOW, but before advising them it’s a good idea to have the proper training. We assume training will in part be skills and workforce development, but that there will also hopefully be some training set aside for how to administer the IRA paperwork trail.

-

To apply for an IRA grant, you will need to have an active SAM.gov and Grants.gov account. The EPA hosts an information page on how to apply, and you should apply as soon as possible, as the process can take a month or more for new applicants (previous federal grant recipients just need to make sure their registrations sare active.)

-

Manufacturers should prepare an IRA Manufacturer's Certification Statement, though it is not clear if this is just encouraged to help identify qualified products or is required. Information on certificates can be found in the Instruction for filling out IRS form 5695 and in a brief Energy Star’s “article” on this topic). The statement efficiently represents or “certifies” that the product or component qualified for a specified tax credit, and should also include space to help the end user record information like the specified equipment, price, date of purchase, date of installation, and other data that can help with tracking and tax filing or rebate processing.

A Review of Residential Inflation Reduction Act (IRA) Credits and Rebates

One reason to focus first on some general information and impact is that the IRA is complicated! But it’s time to dig in and to see specifically what all these incentives are about. The more people who understand the IRA’s details, the more we can help clarify for each other, and the more we can share that information with others and the more buildings we can upgrade sooner.

Home Energy Efficiency and Clean Energy Tax Credits

(or as the White House summarizes these credits to make them clear and appealing, and to “sell” those benefits:: “Making Homes and Buildings Cleaner and More Efficient to Save Consumers Money and Cut Pollution”)

The IRA extended and modified or created over 20 existing tax credits related to energy efficiency and clean energy. Within these credits, there really should be exciting opportunities for every building to improve the building envelope for energy efficiency, health, comfort, savings, and wider environmental benefits. Lifetime caps have also been removed, so you can even phase projects over time while continuing to upgrade and save.

Home Energy Efficiency Tax Credits (also known as credit 25C)

Air Sealing, Insulation, and other Weatherization

Between January 1, 2023 and through 2032, eligible households can claim tax credits of 30% of the total cost of qualified energy efficiency projects, with a cap of $1200 per year. The list of included projects is pretty extensive, including projects to insulate and air seal, as well as appliance purchases and electrical upgrades that enable energy efficiency related purchases. The annual limit is an exciting change, compared to previous lifetime limits, which encourages multiple improvements over time, instead of literally discouraging further work.

Energy Audits

-

Up to 30% or $150 for qualified home energy audits (The White House seems to list this outside the 25C $1200 limit, but other sources see, to place it inside the $1200.)

Building Envelope Components

-

Up to $1200 for insulation materials or systems and air sealing materials or systems

-

Up to $500 for Energy Star compliant exterior doors

-

Up to $600 for Energy Star compliant windows and skylights

-

The New Energy Efficient Home Credit provides up to $5,000 in tax credits for each new energy-efficient home and up to $1,000 for each unit in a multi-family building.

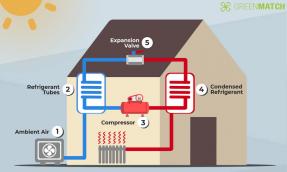

Efficient HVAC Equipment

-

Up to $600 for high efficiency central air conditioners and qualified gas, propane or electric HVAC systems

Heat pumps and biomass stoves and biomass boilers

-

Up to $2000 for electric heat pumps and heat pump water heaters, and biomass stoves and boilers. This $2000 is separate and does not relate to the $1200 annual limit. (Note that once they begin, rebates for heat pump hot water heaters may defray most of the upfront cost for income-eligible consumers)

Electric Vehicle Chargers

-

30% of the cost, up to $1000 (eligibility requirements pending, likely to be targeted to non-urban or low-to moderate income areas.

Home Clean Energy Tax Credits (also known as credit 25D)

-

30% tax credit for clean energy, with no cap, including solar, wind, geothermal, and battery storage (steps down to 22% by 2034)

Inflation Reduction Act (IRA) Residential Rebates Programs:

HEEHRA

The High-Efficiency Electric Home Rebate Act (HEEHRA), is a rebate program designed to support electrification efforts for low-to-moderate income households.

$4.275 billion was allocated to state energy offices, or SEOs, and an additional $225 million for tribal governments to distribute for energy efficiency electric improvement rebates. This funding is only available for households with a total income less than 150% of their area’s median income, or AMI. Notably, the law also includes rebates for income-eligible multifamily buildings, as long as 50% of the building’s occupants qualify as LMI.

Households with between 80% and 150% of AMI are eligible for renates of 50% of projects costs, up to specified funding caps, and households with less than 80% of AMI, or low-to -moderate-income households (LMI) can receive a rebate of 100% of a project’s cost, also up to specified funding caps.

Rebates are to include (for qualifying households, at 100%):

- Building Envelope Improvements:

- $1,600 for weatherization, including air sealing, insulation and windows

- Energy Efficient Appliances:

- $1,750 for a heat pump water heater

- $8,000 for an HVAC heat pump

- $840 for an electric cooktop, stove, range, oven, or heat pump clothes dryer

- $4,000 for electric load upgrades

- An additional $2,500 for electric wiring

There is a $14,000 maximum benefit per home, plus an additional $500 for qualified contractor incentives.

Whole House Energy Rebates (HOMES) Inflation Reduction Act (IRA) Rebates:

The Home owner Managing Energy Savings, or HOMES program, is also a state-administered $4.3 blllion program for whole-house energy efficiency improvements. Under the HOMES program, a single-family home that saves 20-35% of energy costs over a period of time will be eligible for a 50% rebate on project costs, up to $2000. If more than 35% savings are achieved, the rebate can total as much as $4000. Low and moderate income households can earn 80% of project costs up to $4000 for 20-35% gains, and 80% of up to $8000 for savings of 35% or greater. Savings can be modeled, or measured.

Commercial Energy Efficiency and Clean Energy IRA Tax Credits

Four Provisions of the IRA are most Relevant for Commercial Property Owners:

-

179D tax deduction for energy efficiency improvements to existing and new commercial buildings

-

45L tax credit for energy efficiency in residential buildings – multifamily and single family

-

Section 48 Investment Tax Credit (ITC) for renewable energy including solar, combined heat and power (CHP), and energy storage

-

30C tax credit for installation Electrical Vehicle (EV) charging stations (only applies to buildings in low income and rural areas)

179D and 45 L are extended and expanded existing programs. 179D provides building owners or even long term lessees a credit of $2.50 -$5 per square foot for new buildings and retrofits that are 25%-50% more efficient. Credits are available for improvements in three areas: Building Envelope; Heating, Cooling, Ventilation, and Hot Water Systems (HVAC), and Interior lighting systems. Benefits at these levels require owners to pay a prevailing wage and who maintain an eligible apprenticeship program. Owners who do not meet these requirements can only earn a base of .50 to $1 per square foot.

45L is a residential credit for all residential buildings, even high rises, that allows eligible developers to claim a tax credit for each dwelling unit. Both single family homebuilders and multifamily developers can benefit from the 45L Credit. Developers can claim a $2,500 tax credit for single family homes certified as ENERGY STAR Single Family New Homes Program Version 3.1. Rentals that meet the Energy Star standard earn $500 per unit, while those that meet the zero energy ready homes (ZER) standard earn $5,000 per unit.

The expanded Investment Tax Credit (ITC) Section 48 for clean energy investments was extended for at least 10 years and allows project owners or investors to be eligible for federal business energy investment tax credits for installing designated renewable energy generation equipment such as rooftop solar, geothermal, CHP and storage. Section 48 includes stackable bonuses, including a 10% domestic content bonus, a 10% “Energy Community” bonus, and a bonus for low-income communities of 10% or affordable housing and low-income economic benefit projects of 20%. This credit offers the option for "Direct pay" (a/k/a "Elective Pay") where tax-exempt entities previously unable to take advantage of tax credits can now opt to be paid the credit or to transfer portion of the credit to a third-party buyer in exchange for cash

The 30C credit, also extended, is an alternative fuel credit available in low-income or rural areas. Fueling equipment can include for natural gas, propane, hydrogen, electricity, E85, or diesel fuel blends containing a minimum of 20% biodiesel, is eligible. Bidirectional charging equipment is eligible. The credit is for 30% of the cost or 6% in the case of property subject to depreciation, not to exceed $100,000 for commercial properties. Credit is reduced to 6% if prevailing wage and apprenticeship requirements are not met. Permitting and inspection fees are not included in covered expenses. 30C is also available as “direct pay."

Non-Residential Energy Efficiency and Clean Energy Inflation Reduction Act (IRA) Building Funding Opportunities

The total amount of non-residential funding opportunities available for building and development organizations, and even local governments is daunting to understand, and it’s not entirely, readily clear how and when all of this funding can be accessed. But it’s worth trying to understand at a high level how much funding we’re talking about. If your organization is interested in any of this funding or financing, there is no time to lose for further research, as some of the programs are available now, with pending deadlines. That said, some of the processes for some programs are not yet set. It just varies. Opportunities include:

Greenhouse Gas Reduction Fund

-

The EPA will award nearly $27 billion in financial assistance for activities or technologies that reduce or avoid greenhouse gas emissions or help communities do so, with priority to projects without access to other financing.

-

Some of this funding is to be distributed through two competitions, which have already taken place, $20 billion through the General and Low-Income Assistance Competition, and a $7 billion through the Zero-Emissions Technology Fund Competition. Both competitions met the requirements of the Justice40 Initiative, which requires that 40% of the overall benefits of certain federal investments go to disadvantaged communities.

-

The IRA also set aside funds to establish a $27 billion “green bank” to allocate funding in three categories:

-

$7 billion for the Solar for All program providing up to 60 grants to states, tribes, municipalities, and nonprofits for residential and community solar in low-income and disadvantaged communities.

-

$14 billion for the National Clean Investment Fund competition funding 2-3 national nonprofits to partner with private capital providers to provide financing to businesses, communities, community lenders, and others, catalyzing tens of thousands of climate-related projects.

-

-

$6 billion for the Clean Communities Investment Accelerator funding 2-7 hub nonprofits to rapidly scale the capacity of Community Development Financial Institutions (CDFIs), credit unions, local green banks, housing finance agencies, etc. to provide financing to households, schools, small businesses, community institutions, etc. in low-income and disadvantaged communities. These funds prioritize emissions-reductions of existing buildings and netzero new construction.

-

Federal Building Improvements

-

The IRA allocated funds to the GSA for energy efficient and clean energy improvements to federal buildings:

-

$250 million to convert GSA facilities to high-performance green buildings, as part of the Federal Buildings Fund

-

$975 million to support emerging and sustainable technologies and related sustainability and environmental programs, as part of the Federal Buildings Fund, including GSA’s Green Proving Ground Program, which demonstrates innovative technologies in federal facilities to help drive down operational costs and support market transformation

-

Procurement of Clean Construction Materials. The Inflation Reduction Act provides billions to expand government procurement and funding of clean, lower-carbon construction materials and products, expanding the market for these crucial materials. The GSA received $2.15 billion to acquire and install construction materials and products that have substantially lower levels of embodied greenhouse gas emissions. The FHWA received $2 billion to reimburse or incentivize the use of low-embodied carbon

-

See the Summary of the White House One-Year IRA review below for additional investments in clean (postal) vehicles and $500 million in sustainability investments across the Department of Homeland Security, some of which will relate to building and materials.

-

Climate Pollution Reduction, or Greenhouse Gas (GHG) Planning and Implementation Grants (IRA Sec. 60114)(CPRG) for States, Municipal, and Tribal Governments

The Inflation Reduction Act (IRA) also allocates $5 billion in Climate Pollution Reduction Grants to states, municipalities and other public entities to develop plans for addressing GHG pollution.

-

$250 million is allocated for planning grants, with one $3 million grant for each (participating) state to develop plans to reduce GHG, along with smaller grants to the largest 67 metropolitan areas and to tribal governments. See list of state and local entities who have opted in to participate, with planning grants due March 1, 2024 (April 1 for tribes/territories).

-

$4.6 billion for implementation grants will be awarded on a competitive basis. State and local governments must be part of a planning grant to be eligible for implementation grants. EPA released applications guidelines in September 2023, with application deadlines starting in February and final applications due April 1, 2024.

Inflation Reduction Act (IRA) Non-Residential Building Grant and Loan Programs

-

Affordable Housing – HUD Green & Resilient Retrofit Program (IRA Sec. 30002) - Almost $1 billion is available for sustainability and resilience improvements to HUD-supported multifamily affordable housing, including 42.5 million for energy and water benchmarking projects. . Eligible projects include energy or water efficiency; indoor air quality or sustainability; climate resilience; and low emission technologies, materials, or processes such as zero-emission electricity generation, energy storage, or building electrification. Funds will be allocated by three categories:

-

Elements: Up to $750,000 per property or $40,000 per unit for specific resilience or efficiency strategies, such as installing heat pumps, with $140 million in total funding.

-

Leading Edge: Up to $10 million per property or $60,000 per unit for completing a multifaceted renovation that earns an ambitious green building certification such as LEED Zero, with $400 million in total funding

-

Comprehensive: Up to $20 million per property or $80,000 per unit for deep utility retrofits and climate resilience upgrades, with $1.47 billion in total funding.

-

-

Low-Embodied Carbon Materials, ESG and EPD (IRA Secs. 60112, 60111, 60116, 60506) -

-

$250 million for the EPA to provide grants and other support to manufacturing companies for the development, standardization, and transparency of environmental product declarations (EPDs), along with $5 million for similar efforts around corporate climate commitments

-

$100 million for the EPA to collaborate with the Department of Transportation and GSA to develop a program to identify and label low-embodied carbon construction materials and products. The GSA also separately received $2.15 billion, and the Department of Transportation also separately received $2 billion for procurement of low-carbon materials for use in federal projects.

-

Building Energy Code Adoption (IRA Sec. 50131)

-

$1 billion in grants to help state and local governments adopt and implement building energy codes

-

$330 million for meeting 2021 IECC or ANSI/ASHRAE/IES 90.1-2019; $670M for meeting or exceeding the zero energy provisions in the 2021 IECC or an equivalent stretch code. (in addition to $225 million from the Infrastructure Investment and Jobs Act)

-

-

Neighborhood Access and Equity Grants (IRA Sec. 60501) $3 billion for a Neighborhood Access and Equity Grant Program at the Department of Transportation (DOT) to help states and local governments implement walkability, safety, affordable transportation access, and other improvements, including by removing existing transportation infrastructure that adversely impacts communities.

-

- Building Resilient Infrastructure and Communities (IRA Sec. 70006) - Allows FEMA, under the Stafford Act, to use Building Resilient Infrastructure and Communities funds for low-carbon materials and incentives that encourage low carbon and net zero energy projects.

-

Environmental and Climate Justice Block Grants (IRA Sec. 60201) - $3 billion through EPA for grants of up to three years to local governments, universities, or community-based nonprofits (or partnerships of those entities) for environmental projects benefiting disadvantaged communities. Eligible activities include community-led pollution monitoring, prevention, and remediation; low- and zero-emission resilient technologies and related infrastructure; workforce development tied to GHG reduction; mitigating climate and health risks from urban heat islands; climate resiliency and adaptation; and reducing indoor air pollution.

-

Port Air Pollution Reduction Grants (IRA Sec. 60102) $3 billion in competitive grants and rebates through EPA for ports to purchase or install zero emissions port equipment and technology, and to develop climate action plans. $750 million in funding is reserved for ports located in areas designated as nonattainment for air pollution.

-

Coastal Communities and Climate Resilience (IRA Sec. 40001) $2.6 billion through the National Oceanic and Atmospheric Administration (NOAA) for direct expenditures, contracts, grants, and technical assistance to help coastal states, local governments, nonprofits, universities, and others with projects to conserve, restore, and protect coastal and marine habitats and resources, and prepare for extreme storms and other changing climate conditions, among other activities.

-

HFC Phasedown Grants (IRA Sec. 60109) - $38.5 million to EPA to phase down hydrofluorocarbons (HFCs), with $20 million for general implementation of the new phasedown legislation (AIM Act), $3.5 million for deploying implementation and compliance tools, and $15 million for competitive grants for reclaiming HFCs and innovative HFC destruction technologies.

-

DOE Loan Programs Office (IRA Sec. 50141) $40 billion available until 2026 for loans from DOE Loan Programs Office under Section 1703 of the Energy Policy Act of 2005. These loans are intended to support the commercial deployment of cuttingedge clean energy technologies.

Looking Forward - More Inflation Reduction Act (IRA) Activity and Information

There does seem to be growing awareness that the Inflation Reduction Act (IRA) is going to be highly significant to the building industry. Green Builder’s IRA Guide for Green Building Professionals reports that 66.5% of survey respondents are aware of IRA funding pools, and that 63 percent plan to take advantage of funding for upcoming projects, as of June 2023. But that means that over 30% if the industry doesn’t yet know that the tax credits are available now, and that rebates will soon be available that are potentially critical to their future business. Clearly there’s a lot to learn, and we’re just starting to work through the size and impact of this opportunity ourselves here at Rate It Green. As we learn more, we will keep posting, and we hope you will share your expertise and questions with us as well, so we can share all relevant helpful information as widely as possible. This is going to be an impactful, sustainable decade in the green building and building industry, but there’s still so much to learn to achieve the impacts needed. This article has focused on general awareness and IRA tax credits as they are ready, and we should start upgrading and making as many buildings as possible perform better today so people and the wider community can start benefiting. The rebates and additional financing will be available sometime in 2024, and through stare programs that may vary. Below is a summary of the White House Summary of the IRA at one year. The summary reviews all IRA provisions relating to clean energy and climate action. So many directly relate to building, and yet if we count indirect opportunities, the possibilities are seemingly endless. Let’s get to work, and let’s keep communicating!

Inflation Reduction Act (IRA) Total Investments in Clean Energy and Climate Action, a Summary of the White House 1-Year IRA Review:

In January, 2023, the White House published a guide to key Inflation Reduction Act (IRA) Investments in Clean Energy and Climate Action. The list below is really a summary of that summary of the clean energy, climate mitigation and resilience, agriculture, and conservation-related tax incentives and investment programs in the IRA. The guidebook is 184 pages long, so hopefully this abbreviated version can provide a scannable version of what’s in the legislation that relates to buildings and climate. The authors admit that many topics could fall under multiple categories but explain that each time appears only once in the guide. I include this list here as I agree, and it’s worth taking a look at just how many other categories relate to building and energy efficiency in terms of their potential effects on buildings, the people who work in the building and related industries, and also all of us as we occupy buildings. I left the list in order, though I was vexed to see in a summary of key provisions that home energy efficiency and clean energy provisions are listed on page 105. I’d put them front and center for all kinds of reasons, among them that part of the green building industry’s challenge is marketing. To become entirely mainstream and transition to a time where all buildings are built better, healthier and more sustainably, we need to educate and promote, really to cheerlead all we can. And that means not burying something we need everyone to become passionate about on page 105. Then again, perhaps these are just in order of the bill’s provisions. But I’d then have the same complaint. Perhaps that buried lead has something to do with not wanting too much attention to something people might object to, if they don’t understand the importance of climate change mitigation, but also that we can build more healthy, comfortable, durable, and cost effective buildings at the same time that we reduce environmental impact.

Provisions supporting clean energy technology development:

-

Clean Energy Production and Investment Tax Credits (extended)

-

$27 billion investment in the Greenhouse Gas Reduction Fund

-

$40 billion in loan authority to guarantee innovative clean energy projects

Provisions that Support Manufacturing to Build the Clean Energy Economy:

-

Up to $250 billion in new loan authority for Energy Infrastructure Reinvestment Financing

-

$10 billion for extending and expanding the Advanced Energy Project Credit

-

A new Advanced Manufacturing Production tax credit

Energy Grid investments:

In conjunction with grid investments from the Bipartisan Infrastructure Law, including the Transmission Facilitation Program and the Grid Resilience Innovation Partnership, to help build transformative projects that modernize and increase the reliability of the power grid and provide American communities and businesses with better access to affordable, reliable, clean electricity. In January 2022, the Administration launched the Building a Better Grid Initiative to mobilize these and other resources and to support nationwide development of new and upgraded transmission lines. Additionally, the Department of Energy created the Grid and Transmission Programs Conductor to provide updated information on the application process for funding from the Bipartisan Infrastructure Law, Inflation Reduction Act, and other federal financing programs.

-

$3 billion investment in the U.S. transmission system to facilitate high capacity lines

-

$2 billion for transmission facility financing

-

$760 million in grants to facilitate the siting of interstate transmission lines

-

-

$100 million for Interregional and Offshore Wind Electricity Transmission Planning, Modeling and Analysis

Clean Energy Investments specifically in Tribal Lands and in Rural America

-

$9.7 billion for the U.S. Department of Agriculture (USDA) electric infrastructure loan and loan guarantee program for rural electric cooperatives.

-

$1 billion for electric infrastructure loans for renewable energy in Rural America

-

More than $2 billion to expand USDA’s Rural Energy for America Program (REAP). REAP provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or energy efficiency improvements. The Inflation Reduction Act sets aside a portion of this funding for underutilized renewable energy technologies.

-

$150 million to the Tribal Electrification Program at the Department of the Interior. This funding for Tribes and Tribal organizations will support the powering of unelectrified Tribal homes with zero-emissions energy systems and retrofitting of already electrified Tribal homes to zero-emissions systems.

Clean Vehicle Provisions:

In conjunction with the $7.5 billion provided by the Bipartisan Infrastructure Law to deploy a national network of 500,000 electric vehicle chargers; more than $7 billion to ensure domestic manufacturers have the critical minerals and other components necessary for manufacturing electric vehicle (EV) batteries; and $10 billion for clean transit and school buses at the Department of Transportation(DOT) and Environmental Protection Agency (EPA). The CHIPS and Science Act invests in expanding America’s manufacturing capacity for the semiconductors used in electric vehicles and chargers.

-

Clean Vehicle Credit for consumers purchasing new qualifying clean vehicles, including battery electric, plug-in hybrid, or fuel cell electric vehicles, up to $7500 per vehicle

-

Previously-Owned Clean Vehicles Credit, up to $4,000

-

Commercial Clean Vehicles Credit, up to 30 percent of the cost of replacing diesel- or gas-powered commercial vehicles—ranging from cars and pick-up trucks to long-haul trucks—with electric vehicles (may not exceed $7,500 for EVs under 14,000 lbs. and $40,000 for vehicles above 14,000 lbs)

-

An additional $3 billion for the Department of Energy’s Advanced Technology Vehicle Manufacturing Loan Program for loans to manufacture clean vehicles and their components in the United States, including newly authorized uses from the Bipartisan Infrastructure Law, such as medium- and heavy-duty vehicles, locomotives, maritime vessels, aviation, and hyperloop.

-

An additional $2 billion for the Department of Energy for Domestic Manufacturing Conversion Grants, which will fund manufacturers’ retooling of production lines for clean vehicles.

-

An additional $1 billion for the Clean Heavy-Duty Vehicle Program at the Environmental Protection Agency. This program will invest $1 billion to help Tribal, state, and local governments and other entities offset the cost of replacing heavy-duty Class 6 and 7 commercial vehicles with zero-emission vehicles, deploy supporting infrastructure, and train and develop the necessary workforce. At least $400 million of this investment must go to areas not meeting national air quality standards.

Provisions Regarding Cleaner Transportation Fuels:

-

$500 million for the Higher Blend Infrastructure Incentive Program at the U.S. Department of Agriculture (USDA), the goal of which is to increase the sale and use of higher blends of ethanol and biodiesel.

-

Extension of existing tax incentives for alternative fuels and creation of a new Clean Fuel Production Credit. The Inflation Reduction Act extends existing tax incentives for a range of alternative fuels

-

Sustainable Aviation Fuel Credit to incentivize the production of sustainable aviation fuels that result in at least 50 percent less greenhouse gas emissions than petroleum-based jet fuel

-

$297 million for the Alternative Fuel and Low-Emission Aviation Technology Program at the Federal Aviation Administration (FAA)

Industrial Decarbonization and Carbon Management

-

An additional $5.8 billion for the new Advanced Industrial Facilities Deployment Program. The law launched a new program at the Department of Energy, the Advanced Industrial Facilities Deployment Program, to provide financial support to industrial facilities in emissions-intensive sectors, such as the iron, steel, aluminum, cement, glass, paper, and chemicals sectors, to complete demonstration and deployment projects that reduce greenhouse gas emissions through installation or implementation of advanced industrial technologies.

-

Expansion of the Advanced Energy Project Credit to include industrial emissions reduction. Expansion of the the 48C Advanced Energy Project Credit to include projects that reduce greenhouse gas emissions by at least 20 percent at an industrial or manufacturing facility by installing low-carbon heat systems, carbon capture systems, energy efficiency measures, and other pollution reduction technologies and practices

-

Extension and expansion of the 45Q tax credit for carbon capture, utilization, and sequestration (CCUS). The law extends the existing 45Q tax credit, adds an enhanced credit for direct air capture (DAC), and lowers the carbon capture threshold requirements for certain facilities to benefit from the credit.

-

Facilities meeting prevailing wage and registered apprenticeship requirements can qualify for bonus credits. This tax credit complements funding in the Bipartisan Infrastructure law for CCUS and DAC, including $2.537 billion for the Carbon Capture Demonstration Projects Program, $937 million for Carbon Capture Large-Scale Pilot Programs, and $3.5 billion for Regional Clean Direct Air Capture Hubs.

-

$1.55 billion to cut methane pollution from oil and gas industry operations. EPA received $1.55 billion to provide financial and technical assistance to accelerate the reduction of methane and other greenhouse gas emissions from petroleum and natural gas systems by improving and deploying new equipment, supporting technological innovation, permanently shutting in and plugging wells, and other activities. The Inflation Reduction Act also imposes a waste emissions charge on facilities with methane emissions that exceed a certain threshold. This EPA program complements nearly $4.7 billion in the Bipartisan Infrastructure Law to plug and remediate orphaned oil and gas wells on Tribal, federal, state, and private lands.

-

$38.5 million to implement the American Innovation and Manufacturing (AIM) Act, a bipartisan law to phase down the production and consumption of hydrofluorocarbons (HFCs), maximize reclamation and minimize releases from equipment, and facilitate the transition to next-generation technologies through sector-based restrictions.

Investing in Clean Hydrogen

-

Hydrogen Production Tax Credit to incentivize the domestic production of clean hydrogen. (Entities that generally do not benefit from income tax credits, such as state, local, and Tribal governments and other tax-exempt entities can elect to receive these tax credits in the form of direct payments. Certain businesses also can elect to receive the 45V tax credits in the form of direct payments.

Investing in Science and the Department of Energy’s Core Research Mission

-

$1.55 billion to the Department of Energy’s Office of Science to support national laboratory infrastructure improvements.

-

$450 million to support infrastructure improvements at three key national laboratories: the National Energy Technology Laboratory, Idaho National Laboratory, and National Renewable Energy Laboratory.

Protecting Communities from Harmful Air Pollution

-

$3 billion for Environmental and Climate Justice Block Grants. The Environmental Protection Agency’s (EPA) new Office of Environmental Justice and External Civil Rights will provide grants and technical assistance to community-based organizations, alone or in partnerships, to reduce indoor and outdoor air pollution, including greenhouse gasses; monitor for pollution; improve community resilience to the impacts of climate change, including extreme heat and wildfire; and build the capacity of these organizations to engage with state and federal decision-making processes.

-

$5 billion for Climate Pollution Reduction Grants. EPA received $5 billion to provide grants to Tribes, states, air pollution control agencies, and local governments to develop and implement plans for reducing greenhouse gas emissions.

-

$4 billion to reduce harmful air pollution from the transportation sector. EPA received $1 billion for a Clean Heavy-Duty Vehicle Program for grants to Tribes, state and local governments, and other entities to offset the costs of replacing heavy-duty Class 6 and 7 commercial vehicles with zero-emission vehicles and deploying related infrastructure. EPA received an additional $3 billion to provide grants to port authorities; Tribal, state, and local government entities; and other eligible entities to reduce harmful air pollution at ports by purchasing and installing zero-emission port equipment and technology.

-

More than $3.2 billion for the Neighborhood Access and Equity Grant Program. This Department of Transportation grant program will support projects to improve walkability, safety, and affordable transportation access in communities; to clean up existing and prevent new environmental harms caused by transportation projects in disadvantaged communities; and provide planning and capacity building support to disadvantaged and underserved communities. This program complements the Department of Transportation’s Reconnecting Communities Pilot Program, created and funded by the Bipartisan Infrastructure Law to restore community connectivity by removing, retrofitting, or mitigating highways or other transportation facilities that create barriers to community cohesion.

-

$1.55 billion to cut methane pollution from oil and gas industry operations

Improving Pollution Monitoring and Tracking

-

$253 million in investments through several programs to help communities and state, local, and Tribal air agencies add new pollution monitors, including at the fenceline of industrial facilities. In addition, the law gives the White House Council on Environmental Quality new resources to enhance the availability of national level data sets that can help characterize the disproportionate impacts of pollution, climate change, and other socioeconomic burdens on communities; provide a pathway to quantify and address the cumulative burdens on communities; and identify ways to improve outcomes for communities with environmental justice concerns. Funding for air pollution monitoring aligns with and supports the ustice40 Initiative.

Making Homes and Buildings Cleaner and More Efficient to Save Consumers Money and Cut Pollution

In conjunction with investments in the Bipartisan Infrastructure Law, including the Bipartisan Infrastructure Law’s $3.5 billion expansion of the Weatherization Assistance Program to improve home energy efficiency for low-income families; $250 million for the Energy Efficiency Revolving Loan Fund Capitalization Grant Program, through which states can provide loans and grants for energy efficiency audits, upgrades, and retrofits to buildings; and $550 million for the Energy Efficiency and Conservation Block Grant Program, which is designed to assist states, local governments, and Tribes in implementing strategies to reduce energy use and improve energy efficiency.

-

Almost $9 billion for states and Tribes for consumer home energy rebate programs, enabling communities to make homes more energy efficient, upgrade to electric appliances, and cut energy costs

-

The Energy Efficiency Home Improvement Credit (also known as credit 25C) provides up to $3,200 annually in tax credits to lower the cost of energy efficient upgrades by up to 30 percent, including the purchase of heat pumps, insulation, efficient doors and windows, electrical panel upgrades, and energy audits

-

The Residential Clean Energy Credit (also known as credit 25D) provides a 30 percent tax credit to lower the installation cost of residential clean energy, including rooftop solar, wind, geothermal, and battery storage. The credit steps down to 22 percent by 2034.

-

The New Energy Efficient Home Credit (also known as credit 45L) provides up to $5,000 in tax credits for each new energy-efficient home and up to $1,000 for each unit in a multi-family building. This credit incentivizes builders to lower monthly energy costs for future owners and renters by building energy-efficient homes and apartment buildings. Single and multi-family dwellings that meet Energy Star requirements are eligible. To claim the credit, builders must own the property during construction or renovation.

Supporting Investment in Energy Efficient and Low-Carbon Buildings

-

$1 billion for the Green and Resilient Retrofit Program at the Department of Housing and Urban Development (HUD), which will provide funding to the owners of HUDassisted multifamily properties for projects to improve energy or water efficiency; enhance indoor air quality or sustainability; implement the use of zero-emission electricity generation, low-emission building materials or processes, energy storage, or building electrification strategies; or make the properties more resilient to climate impacts. HUD also will conduct energy and water benchmarking of HUD-assisted properties.

-

$1 billion for Department of Energy grants to state and local governments to adopt updated building energy codes, including zero-energy codes.

-

Extension and expansion of the energy efficient commercial buildings deduction passed in 2005 for new or renovated buildings (also known as credit 179D). Buildings that increase their energy efficiency by at least 25 percent will be able to claim this tax deduction of up to $5 per square foot, with bonuses for higher efficiency improvements. The claimant can earn additional bonus deductions by meeting prevailing wage and registered apprenticeship requirements. This deduction is available to commercial building owners, as well as architectural and design firms that have worked on projects for public agency-owned facilities.

Investing in a Sustainable, Lower-Carbon Federal Government

-

$250 million to convert GSA facilities to high-performance green buildings, as part of the Federal Buildings Fund

-

$975 million to support emerging and sustainable technologies and related sustainability and environmental programs, as part of the Federal Buildings Fund

-

$500 million to execute and implement investments associated with sustainability and the environment across the Department of Homeland Security

-

$3 billion for investing in clean energy postal service vehicles. The Inflation Reduction Act includes $3 billion for the U.S. Postal Service to purchase zero-emission delivery vehicles and associated infrastructure.

-

$250 million to support the development and standardization of Environmental Product Declaration (EPDs)—a document that presents environmental information on the lifecycle of a product—including measurements of the embodied greenhouse gas emissions of construction materials and products.

-

$100 million for low carbon labeling for construction materials, to enable the Environmental Protection Agency to work with the Federal Highway Administration (FHWA) and General Services Administration (GSA) to develop and implement a program to identify and label construction materials and products that have substantially lower levels of embodied greenhouse gas emissions.

-

Procurement of Clean Construction Materials. The Inflation Reduction Act provides billions to expand government procurement and funding of clean, lower-carbon construction materials and products, expanding the market for these crucial materials. The GSA received $2.15 billion to acquire and install construction materials and products that have substantially lower levels of embodied greenhouse gas emissions. The FHWA received $2 billion to reimburse or incentivize the use of low-embodied carbon

Supporting Smart Agriculture and Rural Economic Development

-

$8.45 billion for the Environmental Quality Incentives Program, tol provide technical and financial assistance to producers to address natural resource concerns and deliver environmental benefits, such as improving soil carbon and sequestering carbon dioxide

-

$4.95 billion for the Regional Conservation Partnership Program, which will support partner-driven conservation projects that help agricultural producers and nonindustrial private forestland owners improve soil carbon, sequester carbon dioxide, or otherwise reduce emissions

-

$3.25 billion for the Conservation Stewardship Program, which will offer technical and financial assistance to compensate agricultural and forest producers who adopt conservation practices

-

$3.1 billion to provide relief to distressed farm loan borrowers

Investments in Preserving and Protecting Lands and Waters for Climate Mitigation and Resilience

-

$2.6 billion to support coastal resilience and conservation, restoration, and protection of coastal and marine habitat and resources, including fisheries

-

$1.8 billion to complete hazardous fuels reduction projects on National Forest System land within the wildland-urban interface

-

$1.5 billion for the Urban and Community Forestry Assistance Program

-

$700 million for the Forest Legacy Program to acquire lands that offer natural carbon sequestration benefits and $500 million to carry out conservation, habitat restoration, and resiliency projects on lands administered by the Bureau of Land Management and the National Park Service.

Supporting Communities’ Resilience to Drought, Flooding, and Other Climate Impacts

-

$4 billion for Bureau of Reclamation projects to mitigate the extreme drought conditions in the Colorado River Basin, as well as other basins experiencing comparable levels of long-term drought. This funding builds on the $8.3 billion the Bureau of Reclamation received for drought mitigation and response under the Bipartisan Infrastructure Law to improve the resilience of Western water infrastructure

-

$550 million for Bureau of Reclamation projects to provide domestic water supplies to disadvantaged communities or households that do not have reliable access to domestic water supplies

-

$235 million to support Tribal climate resilience efforts, including fish hatcheries

Improving Climate Science and Weather Forecasting

-

$200 million invested in research and forecasting for weather and climate

-

$190 million for computing capacity and research for weather, oceans, and climate

-

$123.5 additional funding

Making Permitting of Energy Infrastructure More Efficient and Effective

-

$350 million for the Federal Permitting Improvement Steering Council

-

$30 million for the Council on Environmental Quality (CEQ)

-

$625 million to multiple federal agencies to support efficient environmental reviews that are timely, robust, and conducted through a transparent process that includes community engagement

*With a stated name and goal to reduce inflation, it’s worth noting that in addition to energy efficiency, clean energy and other climate investments, the IRA’s other main provisions include the creation of a 15% corporate minimum tax rate, prescription drug price reform, increased IRS tax enforcement, and the extension of the Affordable Care Act. While some of these measures do seem like they’d exert negative pressure on inflation, and they do represent elements of long pending social welfare initiatives, the likely direct effect on inflation is not estimated to be significant. One could argue this bill was a great way to make significant climate mitigation gains without the fanfare - and attention - a bill with a more climate-friendly name would attract. As the World Resources institute notes in reporting on retroactive negative attention for the IRA: “As the law’s economic benefits are increasingly felt across the country, it may make any efforts to repeal these measures politically challenging. To do so would mean stemming tax credits, private investments and supply chains, all of which are now in motion. And the law is likely to become even more popular among residents of rural and suburban communities where manufacturing expansions and job growth are already beginning to take place.” (So it’s worth thinking about whether there was a method to this naming madness, and also whether this was entirely ethical.)

Additional Rate It Green IRA Related Resources:

(We'll be adding to this list!)

Inflation Reduction Act Tools & Resources

*The information in this article does not, and is not intended to, constitute tax advice or legal advice. All information is for general information purposes only. Please contact your attorney with respect to any legal matter.

- Filed Under: Government Policies

- ( 2602 ) views

The Rate It Green Team - This is an account for Allison and plenty of kind helpers, for sharing information when/where it really doesn't particularly matter which of us actually posted. Questions? Send us a note through our contact form, or email info@rateitgreen.com.

- ( 0 ) Ratings

- ( 105 ) Discussions

- ( 6 ) Group Posts

Reply/Leave a Comment (You must be logged in to leave a comment)

Connect with us!

Subscribe to our monthly newsletter:

Inflation Reduction Act (IRA) - Tools & Resources Sep 26, 2023

Inflation Reduction Act (IRA) - Tools & Resources Sep 26, 2023 The Role of Data: Adaptive Building Aug 08, 2023

The Role of Data: Adaptive Building Aug 08, 2023

Not a Member Yet? Register and Join the Community | Log in